If you are not sure which version of the Form 1040 to use, contact a licensed tax preparation specialist. The IRS conducts random audits of tax returns, and inaccurate tax filings can lead to penalties and liens on your property. Helpful informationīe sure to complete your Form 1040 accurately. To find the appropriate mailing address, visit the IRS Website. Residents may complete the form with a pen or computer, and mail them to the location listed for their state of residence. Personal Income Tax Forms Everyone who is required to file a New Mexico personal income tax return must complete and file a form PIT-1, New Mexico Personal. An IRS Verification of Nonfiling Letter (VNF) will provide proof from the IRS that there is no record of a filed tax form (1040, 1040A, or 1040EZ) for the. The IRS still accepts physical copies of Form 1040 for tax returns. To use the IRS’ Free File Tool, residents must have less than $62,000 in annual income, and must meet additional requirements for deductions and income sources.

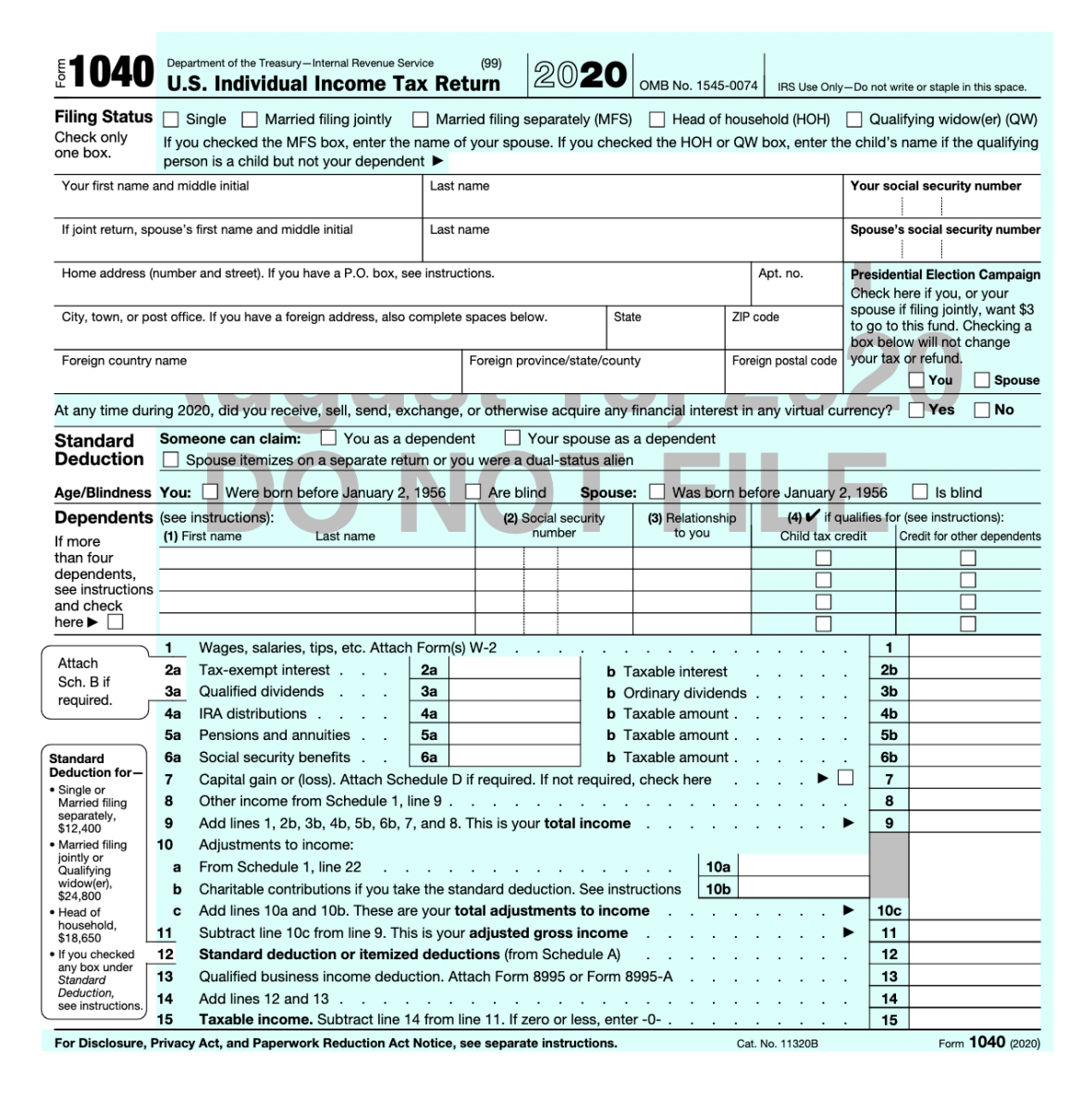

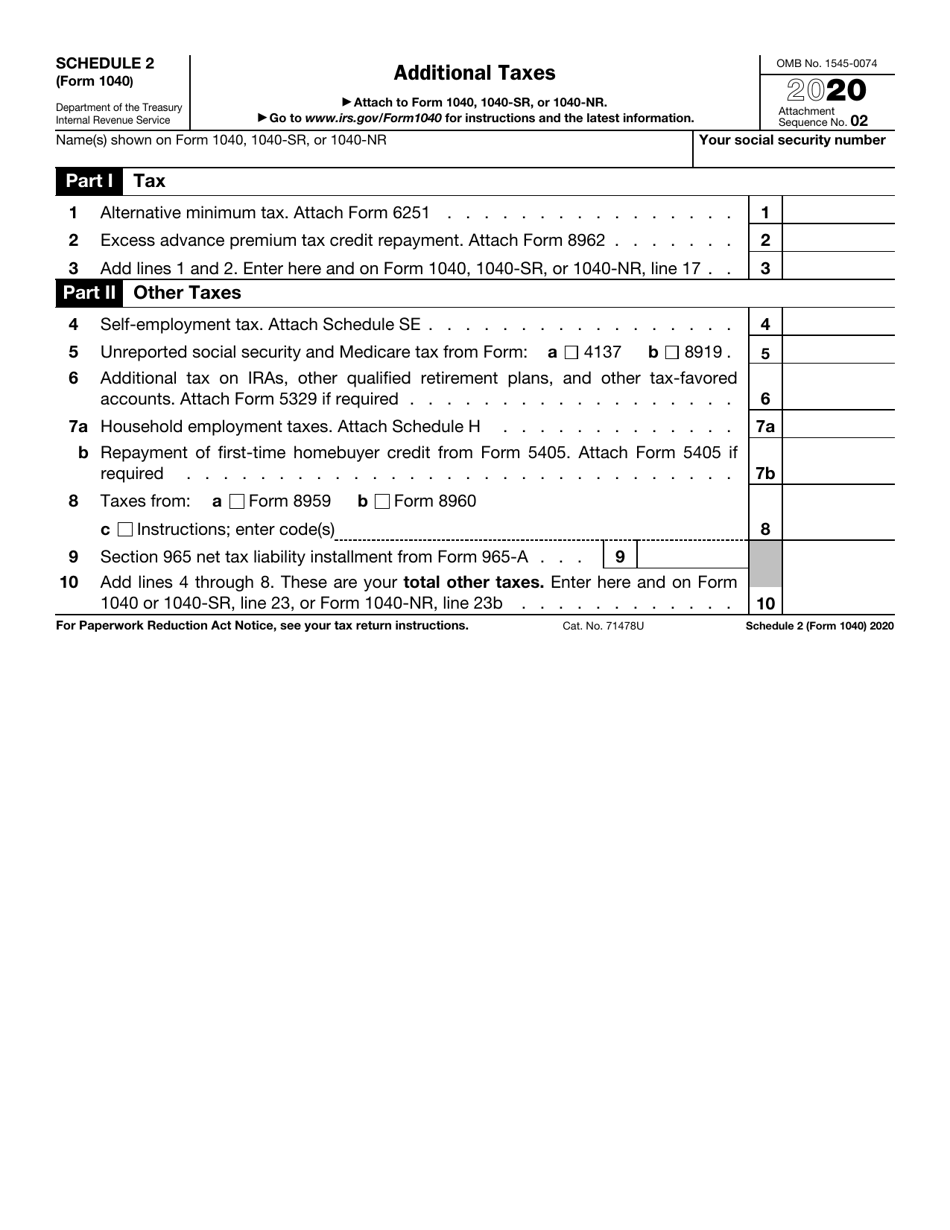

It’s important to understand which forms you need to file so that the IRS is able to complete your tax return accurately. Keep in mind that there are several versions of the Form 1040, including: On the second page, you’ll fill out information related to the tax deductions and credits that you qualify for. On the first page of the Form 1040 (x, you’ll fill out information about yourself, your dependents, and your income. Form 1040 is a lengthy document, consisting of nearly 100 lines that must be completed prior to submission.

0 kommentar(er)

0 kommentar(er)